This chapter contains the following topic:

Introduction to Past-due Amounts

The Customer selection contains a field not only for the customer’s total balance due, but for his past-due balance as well. The former amount is maintained automatically, as invoices and receipts are posted; but the latter can be maintained at will. You can reset this amount directly, in Customers (provided you are authorized to make a protected change), but the normal method of doing so is to run this selection. Calculate past-due amounts recalculates the past-due balance on all customers.

This is computed simply by totaling the unpaid balance of all invoices not paid as of the due dates indicated by the terms code of those invoices. No grace period is allowed.

It is also possible to recalculate the past-due amount on an individual customer only, using the View(Customers) selection.

The past-due amount field appears on various reports, but is informational only. If you are not concerned to maintain this field, this chapter does not apply. In particular, this selection has no connection to:

| • | The aging periods used for various reports such as the Collections Report or Aging Report. |

| • | The finance charge calculation. |

Whichever way the past-due amount has been calculated, the date as well as the amount of the calculation is stored in the customer record.

As a rule of thumb, the system assumes that past-due amounts are current if they have been calculated today, but are not current otherwise. Neither of these assumptions is necessarily true of course, but they serve as a basis for issuing warnings:

| • | If you run Calculate past-due amount a second time on the same day, you are informed of that fact. |

| • | If you print a report that displays past-due amounts (such as the Collections Report), and Calculate past-due amount has not been run that same day, you are informed of the last date that Calculate past-due amount was run and asked whether you wish to continue. |

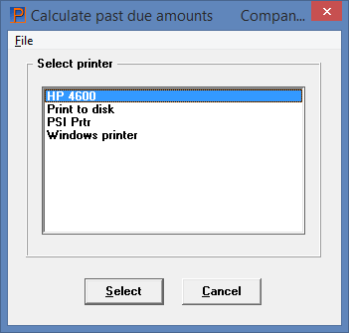

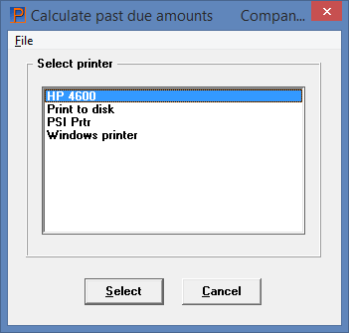

Select

Calculate past due amount from the Open items menu.

All customers are processed unconditionally. You will be asked to select a printer similar to this screen:

A -PDF- and -PDFP- printer is not allowed because this is considered an audit trail report.

The Past Due Customer Update List is considered a register and can not be displayed on the screen. View a Past Due Customer Update List example in the Sample Reports appendix.

The Past Due Customer Update List shows all customers with past-due amounts. New past-due customers have an asterisk to the left of their name.

Data Discrepancy Between Customer Balance and Open Items

After selecting a printer, if you see this message displays:

For Customer 9999999999,

Discrepancy between customer balance and open item file

then under the report Customer Name field it will print

Discrepancy with OI file.

This means that there is a difference between the past due amount total as calculated from Open items and the customer balance field in the customer record. This message will display for each customer where there is a difference.

You may correct the data by printing the aging report for the customer with a discrepancy and then update the Account balance amount on the customer record. You must allow protected changes to access this field. Do this for each customer with a discrepancy.

|

Note |

In a case like this, when the data between two files/tables become out-of-sync there may be a specific cause that needs to be addressed. Otherwise the problem could recur. Please contact your PBS provider for suggestions. |